保险用英文

Understanding Insurance: Explained in English

Insurance is a financial arrangement that provides protection against potential losses or risks. It operates on the principle of risk pooling, where individuals or entities pay premiums to an insurance company in exchange for coverage against specified risks. Here's a breakdown of key terms and concepts related to insurance:

1.

Policy

: A contract between the insured (the person or entity seeking coverage) and the insurer (the insurance company), outlining the terms, conditions, and coverage details.2.

Premium

: The amount of money the insured pays to the insurer in exchange for coverage. Premiums can be paid on a regular basis (monthly, quarterly, annually) or as a onetime payment.3.

Coverage

: The scope of protection provided by an insurance policy. This can include various risks such as property damage, liability, health expenses, or loss of income.4.

Deductible

: The amount the insured must pay outofpocket before the insurance coverage kicks in. For example, if a policy has a $500 deductible for car repairs and the repair costs $1,500, the insured would pay $500, and the insurance company would cover the remaining $1,000.5.

Claim

: A formal request made by the insured to the insurance company for compensation or coverage of a loss or damage covered by the policy.6.

Beneficiary

: The person or entity designated to receive the benefits or payouts from an insurance policy in the event of a covered loss.7.

Underwriting

: The process by which insurance companies assess and evaluate the risks associated with insuring a particular individual or entity. This helps determine the premium rates and coverage eligibility.8.

Types of Insurance

:

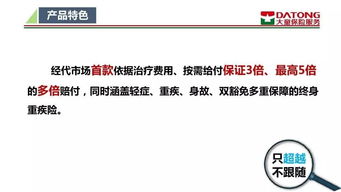

Life Insurance

: Provides financial protection to beneficiaries in the event of the insured's death.

Health Insurance

: Covers medical expenses incurred by the insured, including hospitalization, medication, and preventive care.

Auto Insurance

: Protects against financial loss in case of accidents, theft, or damage to vehicles.

Homeowner's Insurance

: Provides coverage for damages to a home and its contents, as well as liability protection against accidents that occur on the property.

Liability Insurance

: Offers protection against claims resulting from injuries or damage to other people or property.9.

Riders

: Additional provisions or endorsements that can be added to an insurance policy to customize coverage based on specific needs or circumstances. For example, adding a rider to a life insurance policy for accidental death coverage.In summary, insurance is a mechanism for transferring the financial risk of potential losses from individuals or entities to insurance companies in exchange for payment of premiums. Understanding the key terms and concepts associated with insurance can help individuals make informed decisions when selecting coverage options to mitigate various risks they may face.

免责声明:本网站部分内容由用户自行上传,若侵犯了您的权益,请联系我们处理,谢谢!联系QQ:2760375052